FAFSA Information

Completing the Free Application for Federal Student Aid (FAFSA) is the first step to help you finance your education at Commonwealth University.

The FAFSA (Free Application for Federal Student Aid) is a free application that helps determine your eligibility for various state and federal aid, as well as need-based aid here at Commonwealth University. Even if you think you or your family won't qualify for need-based aid, it's important to file the FAFSA every year while you're enrolled in college as it may help you receive grants, scholarships, loans and even employment to help pay for college.

The FAFSA is available for the 2025-2026 academic year is now available. If you're a PA resident, you should complete the FAFSA by May 1, 2025 for potential state aid eligibility through PHEAA (Pennsylvania Higher Education Assistance Agency). Please remember, filing the FAFSA is FREE! Any fee for service request for application submissions are neither endorsed nor necessary for financial aid.

Additional Information

- About Your StudentAid.gov account (FSA ID)

Before you file the FAFSA, you need to create a StudentAid.gov account (FSA ID) which is a unique username and password you'll use to access all Federal Student Aid websites. You'll use it for multiple years so we recommend you store it in a safe location that you will remember. If you're a dependent student, your parent/supporter will need to create their own parent StudentAid.gov account (FSA ID) for use on these sites as well.

- Please use Federal Title IV Code on the FAFSA: Commonwealth University of Pennsylvania 003315

FAFSA FAQs

- Please use Federal Title IV Code on the FAFSA: Commonwealth University of Pennsylvania: 003315

- Student and parent StudentAid.gov accounts (FSA IDs)

- Student and parent Social Security numbers

- Student and parent prior, prior year federal income tax returns (include Schedule 1, 2 & 3 if applicable) Note: All students/contributors will be required to provide consent for tax information to import into the FAFSA via the Direct Data Exchange (DDX).

- Student and parent prior, prior year W-2 forms and other records of money earned

- Student and parent prior, prior year untaxed income received including: workers’ compensation, child support, payments to tax deferred pension, savings plans, etc.

- Current bank statements & records of stocks, bonds, 529 plans and other investments

- Cash, checking & savings accounts

- Real estate (other than home you live in)

- Financial assets, such as: stocks, bonds, certificates of deposit, mutual funds & money market accounts

- UGMA/UTMA custodial accounts

- College Savings plans, including: 529 plans and Coverdell accounts (list as a parent asset)

- Your primary residence (the home you live in)

- Retirement plans

- Qualified life insurance policies

- Personal possessions

- Initial Application - 30 min

- Renewal Application - 15 min or less

- FAFSA Correction - 10 min or less

You're considered a dependent for the 2025-2026 academic year and required to provide parent information unless you can answer YES to one of the following questions:

- Were you born before January 1, 2002?

- As of today, are you married?

- At the beginning of the 2025-2026 school year, will you be working on a graduate/doctoral program?

- Are you currently serving on active duty in the U.S. Armed Forces for purposes other than training, or are you a veteran of the U.S. Armed Forces?

- Do you have children or dependents who will receive more than half of their support from you between July 1, 2025 and June 30, 2026?

- At any time since you turned 13, were both your parents deceased, were you in foster care or were you a dependent ward of the court?

- As determined by a court in your state of legal residence, are you or were you an emancipated minor?

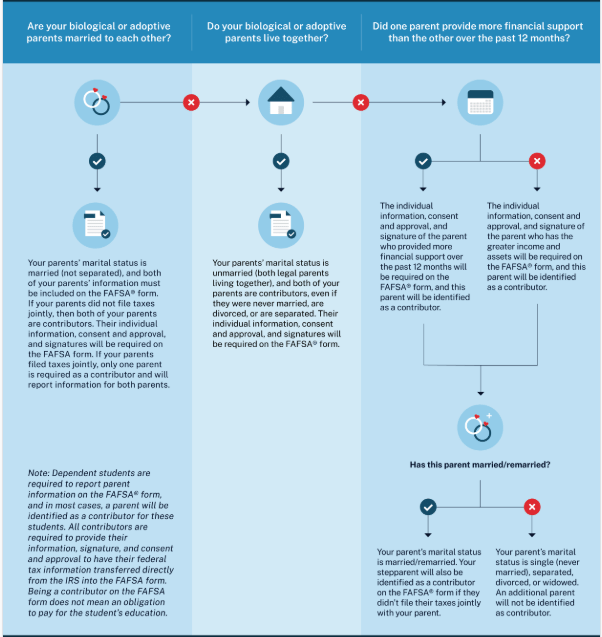

Dependent students are required to report parent information on the FAFSA. A parent means your legal (biological or adoptive) parent or a person that the state has determined to be your legal parent. A stepparent is considered to be a parent if they have adopted you. Stepparents that have not adopted you will be identified as parent spouse.

The following people are not your parents unless they have legally adopted you:

- Widowed Stepparent

- Grandparents

- Foster Parents

- Legal Guardians

- Older Siblings

- Aunts or Uncles

Contact Us

- University-wide

- Bloomsburg

- Lock Haven

- Mansfield